Don't be fooled!

Duty of disclosure

-

What the Ombudsman has to say about 'Non-disclosure' in insurance cases?

"Non-disclosure" refers to the situation where a customer fails to reveal a relevant fact when applying for – or renewing – an insurance contract. It is widely recognised that in some situations involving non-disclosure, applying the strict legal position can result in an unduly harsh outcome for the customer. For this reason, when we deal with insurance cases involving non-disclosure or "misrepresentation" – an incorrect statement made by a customer – we take account of both the law and good industry practice.

The Legal Position

An insurance contract is a "contract of utmost good faith", which means that all parties to the contract are under a strict duty to deal fully and frankly with each other. Customers must disclose all facts that are "material" (or relevant) to the risk for which they are seeking cover.

A "material" fact is one which would influence an underwriter when they were deciding whether to accept the risk, and the terms and conditions that should apply. If a customer fails to disclose (or misrepresents) a material fact and this induces the insurer to accept the proposed risk, the legal remedy is to "avoid" the policy. This means the insurer is entitled to treat the policy as though it never existed. Unless fraud is involved, the insurer will normally return the premium and will not pay out on any claim made under the policy.

-

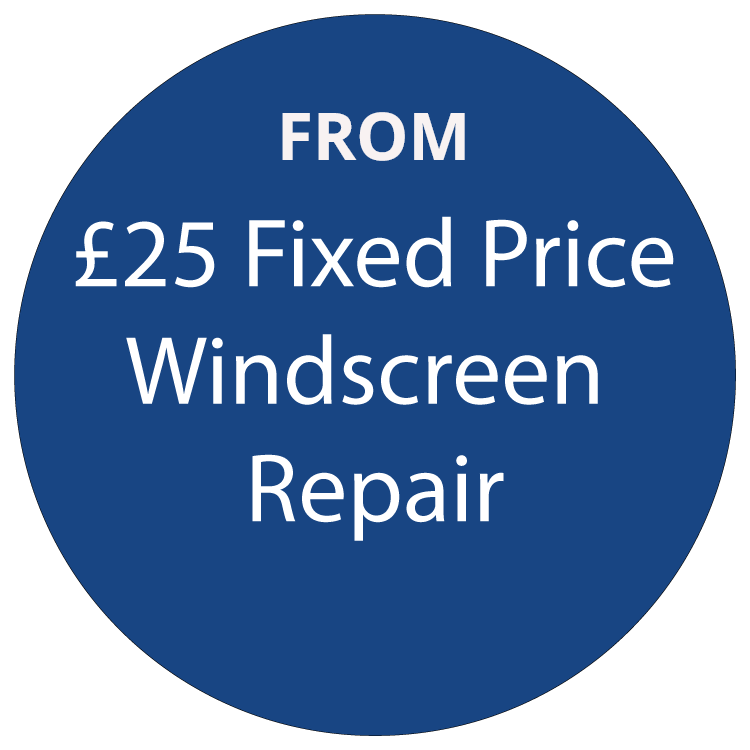

How & Why we are so competitive on Price and a Final Word of Warning

How? National companies operate on a 'franchise' or a 'license' basis. That means the franchise operator either paid a fortune for the rights to a local postcode area and his charges reflect that investment or the licensor has provided the licensee with a van and all the tools of the trade in return for up to 60% of his turnover. This is designed to motivate him because he only gets to keep 40% of his turnover out of which he has to cover all his fuel and vehicle running costs

End result ~ A massively overpriced repair bill to the end user... YOU!

Why? Although we utilise the best screen repair system in the world (the patented G3 Glasweld system) and were trained by GLASWELD UK, we now operate as an independent 'Glasweld System' repair technicians so we no longer have massive repayments to meet on franchise fees nor do we have to remit up to two thirds of our turnover back to a 'parent' company.

The winner in all this is of course YOU ~ the customer. This is because you benefit from our years of company training and experience at a FRACTION OF THE COST charged by our competitors.

One Final Word of Warning!

There's another saying - 'You get what you pay for.' That one is patently untrue. Price is no guarantee whatsoever of quality where screen repair is concerned. If you are naive enough to authorise a supermarket car park cowboy to carry out a 'Free' insurance repair to your windscreen with a 'kit' he bought on eBay, then you will quickly learn the truth behind that other old adage 'You deserve what you get' because an inferior repair will almost certainly fail to meet the required MOT standard. Irrespective of price, it's almost impossible to rectify a 'bad repair' ... and you risk having to replace the windscreen anyway or being stuck with an unsightly scar on your windscreen for the life of the vehicle

Contact Us

We will get back to you as soon as possible

Please try again later